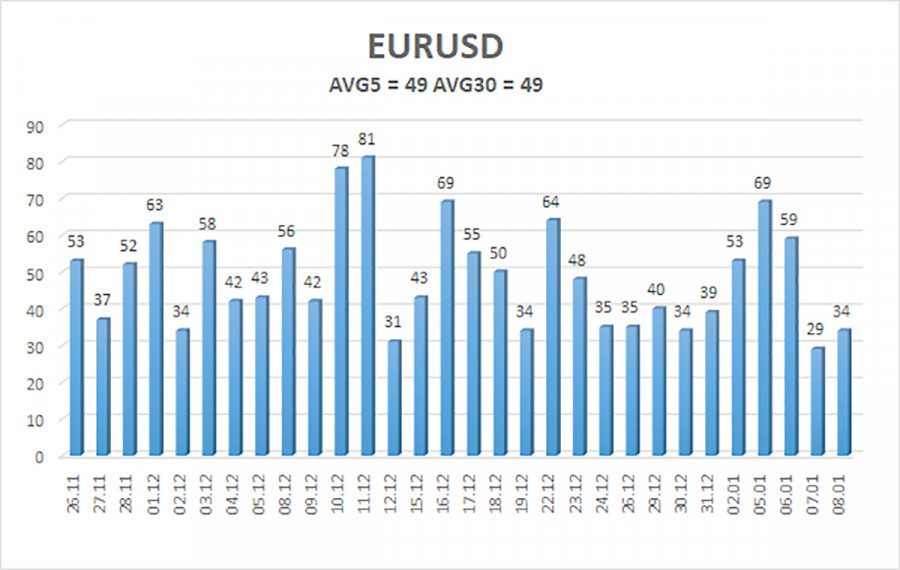

The EUR/USD currency pair maintained its downward trend throughout Thursday but once again traded very weakly. At the beginning of the current week—and of the new year as a whole—we saw some increase in activity in the foreign exchange market, but Wednesday showed that it was too early to celebrate. Despite a strong and abundant macroeconomic backdrop, the EUR/USD pair showed volatility of just 29 points—laughably low. Thus, we once again return to two important factors that currently determine movements of the euro against the dollar: volatility and a flat market.

Volatility has been steadily declining over recent months, which is explained by the price remaining within the 1.1400–1.1830 sideways channel for six months. However, these factors are still better considered separately. At present, the 30-day average volatility is 49 points, which is extremely low. It should be understood that this is not a temporary calm but a long-term trend. Therefore, on any given trading day, traders currently cannot expect strong price movements.

A flat market is a separate issue altogether. Of course, a flat market on any instrument and timeframe is a completely normal phenomenon. However, in this case, it has lasted too long. We cannot influence this, so we continue to state the obvious. The clearest example of the market's reluctance to trade this week was Wednesday, when relatively important inflation data were released in the European Union, and relatively important ADP, JOLTS, and ISM Services reports were published in the United States. Some reports favored the euro, others favored the dollar, but by the end of the day the EUR/USD pair showed no desire to move either up or down. Therefore, we once again remind traders that regardless of the technical picture and trading signals, if there is no market movement, there is nothing to trade.

Today may become a "resolution," or it may turn into a disappointment. It is quite possible that the market does not want to open positions actively ahead of Friday, which will show the current state of the labor market and unemployment. At the same time, how many such Fridays and other important days have there been over the past six months? Throughout all this time, the price has remained in a sideways channel, and volatility has been steadily declining. Thus, it is entirely possible that for a short period of time (several hours) the market will become more active and we will see a move upward or downward (depending on the nature of U.S. statistics). However, if price movements are again weak or absent, or if volatility quickly returns to its usual levels, this should not come as a surprise.

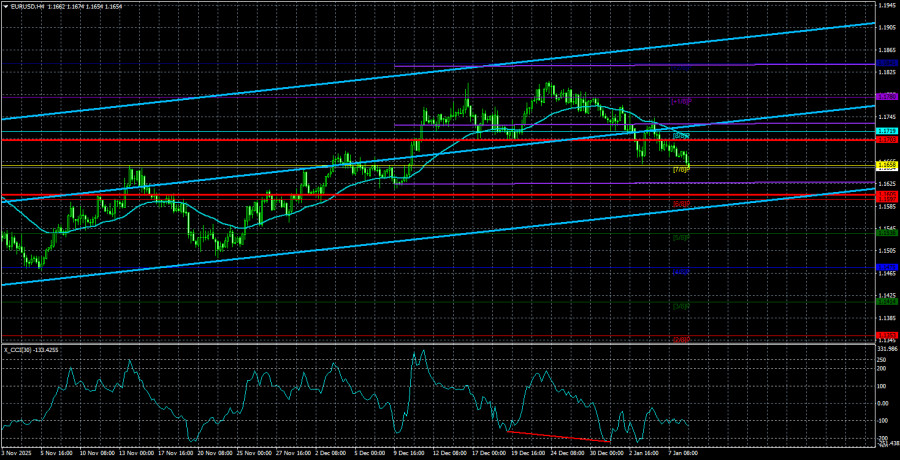

From a technical perspective, the pair may continue to decline on both the 4-hour and daily timeframes. On the daily timeframe, the price reversed near the upper boundary of the flat range, so a decline toward the lower boundary would be justified. On the 4-hour timeframe, the pair is trading below the moving average.

The average volatility of the EUR/USD currency pair over the last five trading days as of January 9 is 49 points and is characterized as "low." We expect the pair to move between the levels of 1.1605 and 1.1703 on Friday. The higher linear regression channel is directed upward, but in practice a flat market on the daily timeframe continues. The CCI indicator entered the overbought zone at the beginning of December, and a small pullback has already occurred. A bullish divergence was formed last week, indicating a resumption of the upward trend, but it remains unfulfilled.

Nearest support levels:

- S1 – 1.1658

- S2 – 1.1597

- S3 – 1.1536

Nearest resistance levels:

- R1 – 1.1719

- R2 – 1.1780

- R3 – 1.1841

Trading Recommendations

The EUR/USD pair remains below the moving average, but an upward trend persists on all higher timeframes, while a flat market has continued for the sixth consecutive month on the daily timeframe. The global fundamental background remains highly important for the market and continues to be negative for the dollar. Over the past six months, the dollar has occasionally shown weak growth, but exclusively within the sideways channel. It lacks a fundamental basis for long-term strengthening.

With the price located below the moving average, small short positions may be considered on purely technical grounds with targets at 1.1605 and 1.1536. Above the moving average, long positions remain relevant with a target of 1.1830 (the upper boundary of the flat range on the daily timeframe), which has effectively already been tested but not broken.

Explanations to the Illustrations

- Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is considered strong.

- Moving average line (settings: 20.0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for price movements and corrections.

- Volatility levels (red lines) represent the likely price channel in which the pair will trade over the next 24 hours, based on current volatility readings.

- CCI indicator – entering the oversold zone (below ?250) or the overbought zone (above +250) signals that a trend reversal in the opposite direction may be approaching.