The GBP/USD currency pair continued to trade quite calmly on Wednesday, considering the scheduled macroeconomic background. Let us recall that a large number of reports on inflation, unemployment, and the labor market are published. For example, inflation reports include the Producer Price Index, core inflation, headline inflation, and the Personal Consumption Expenditures Price Index. Unemployment reports include the unemployment rate itself and weekly initial jobless claims. Labor market reports include the JOLTS report on job openings, the ADP report on private-sector employment, and the Nonfarm Payrolls report on changes in employment in the non-agricultural sector. Most of the reports listed above have a local character.

Let us clarify what we mean. Inflation in the United States can be assessed only by the Consumer Price Index. All other reports are derivatives of it. Unemployment can be judged only by the unemployment rate itself. Among labor market reports, Nonfarm Payrolls have the greatest accuracy and relevance. It is no secret that the ADP report is rather inaccurate and does not cover certain sectors of U.S. employment. The JOLTS report reflects job openings, but not changes in the level of employment of the U.S. population. Moreover, it is published with a two-month lag. Thus, conclusions can be drawn only from Nonfarm Payrolls, the unemployment rate, and the Consumer Price Index. The first two will be released on Friday, while the latter will be published next week.

Recall that a rather formal conflict of opinions has emerged within the FOMC. Why "formal"? Because only three Committee members advocate a continued reduction in the key interest rate: Steven Miran, Michelle Bowman, and Christopher Waller. All of them are, in one way or another, connected to Donald Trump, who has been demanding monetary policy easing from the Federal Reserve for an entire year. The remaining Fed officials adhere to a balanced approach and do not forget about both mandates: price stability and full employment. Therefore, nine members of the FOMC vote on interest rates depending on macroeconomic data. As for the opinion of Trump's "trio," we suggest not taking it into account. There are still not enough "outright doves" within the Fed to influence the voting process.

Thus, from our point of view, there is no conflict of interest. Jerome Powell announced in December that the Fed needs a pause, so most likely monetary policy parameters will remain unchanged in January. Nevertheless, reports on the labor market, unemployment, and inflation remain extremely important, as they will allow the market to form expectations regarding further policy changes. And the market likes to form its own expectations in advance and then price them in advance to maximize profits. The British pound retains excellent prospects for further growth, both from a technical and a fundamental standpoint.

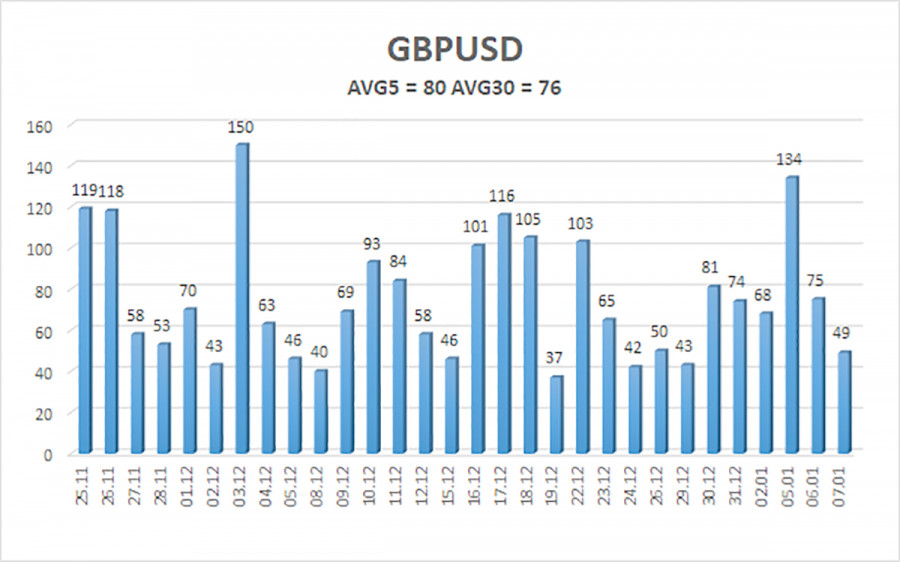

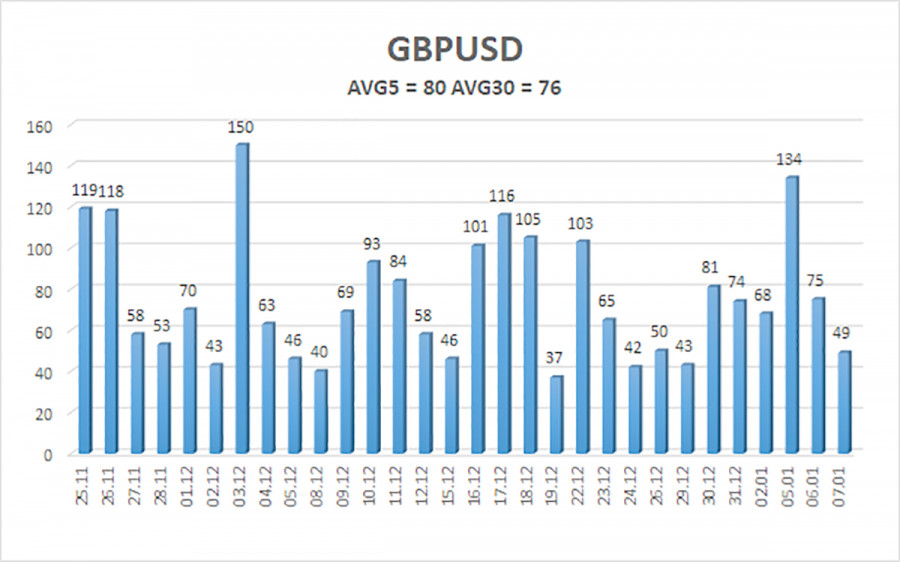

The average volatility of the GBP/USD pair over the last five trading days is 80 points. For the pound/dollar pair, this value is considered "average." Thus, on Thursday, January 8, we expect price movement within the range bounded by 1.3393 and 1.3553. The senior linear regression channel has turned upward, indicating a recovery of the trend. The CCI indicator has entered the oversold zone six times over recent months and has formed multiple bullish divergences, consistently warning traders of a continuation of the upward trend.

Nearest support levels:

S1 – 1.3428S2 – 1.3306S3 – 1.3184

Nearest resistance levels:

R1 – 1.3550R2 – 1.3672R3 – 1.3794

Trading Recommendations:

The GBP/USD currency pair is attempting to resume the 2025 uptrend, and its long-term prospects remain unchanged. Donald Trump's policies will continue to put pressure on the U.S. economy, so we do not expect growth from the U.S. dollar. Therefore, long positions with targets at 1.3550 and 1.3672 remain relevant in the near term as long as the price is above the moving average. If the price is below the moving average line, small short positions with a target of 1.3393 can be considered on technical grounds. From time to time, the U.S. currency shows corrections in global terms, but for trend-based strengthening it would need signs of the end of the trade war or other global positive factors.

Explanation of the Illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same direction, the trend is currently strong.

- The moving average line (settings: 20,0, smoothed) determines the short-term trend and the direction in which trading should currently be conducted.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) indicate the probable price channel in which the pair will trade over the next 24 hours, based on current volatility readings.

- The CCI indicator: entering the oversold zone (below ?250) or the overbought zone (above +250) signals that a trend reversal in the opposite direction is approaching.