The GBP/USD currency pair traded rather sluggishly on Monday, with a downward corrective bias. However, we did not expect the market to surge just two days before the New Year and a few days after Christmas. It's a festive pause in the market. Indeed, we observe some price fluctuations, but these fluctuations have no significant impact and are essentially meaningless.

For the British pound, the situation remains rather mundane, especially on the daily timeframe. Over the weekend, we presented articles with a detailed analysis of this chart. On it, the GBP/USD pair has overcome the Ichimoku cloud after a classic three-wave correction that lasted about 4-5 months. Of course, this does not mean that the British currency cannot decline under any circumstances while the dollar rises. Here, fundamental analysis comes to our aid. What global, fundamental reasons does the dollar have to rise? This is the question we have been asking for three-quarters of 2025, and so far, we have not found an answer. Moreover, we believe that even within the second half of 2025, the dollar has "exceeded its plan." The US currency has risen stronger and longer than warranted by fundamentals. For instance, the European currency has found no reason to drop against the US dollar and has been trading flat for the past 6 months.

The British pound had reasons to fall in the second half of 2025, but these reasons were not strong enough to drive a 45% adjustment within the context of a global trend. Recall that the Bank of England, unlike the European Central Bank, continues to ease monetary policy, making the euro's position stronger than that of the British pound. Additionally, confusion arose in the UK regarding the budget for 2026 this autumn. Rumors circulated that Treasury Secretary Rachel Reeves would resign, and under pressure from criticism of her budget, she broke down in tears multiple times in Parliament. Ultimately, she raised a whole range of taxes to close the "gaps" in the budget.

It may seem that the pound's decline in response to these events is quite logical, but at the same time, where is the repercussion from the "shutdown," which is nothing less than similar budgetary chaos for 2026 in the US? Only in Britain was it possible to avoid a shutdown of government operations and all public structures, unlike in America. Thus, with the same set of problems, we believe it is the dollar that should have been falling this autumn, especially against the backdrop of renewed Fed monetary easing and the dismal state of the labor market.

Based on this set of factors and analytical conclusions, we believe that the global upward trend will be restored in any case. Therefore, the dollar's minimal growth during the New Year holidays does not bother us at all. Let's consider it a holiday gift.

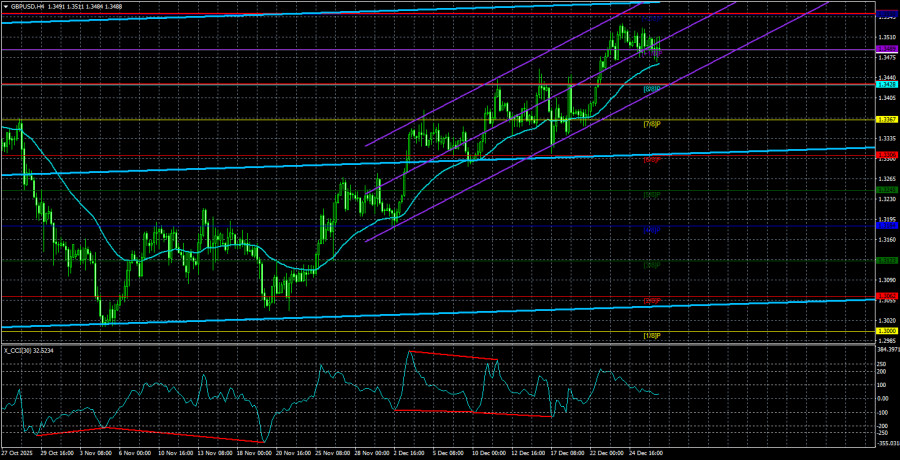

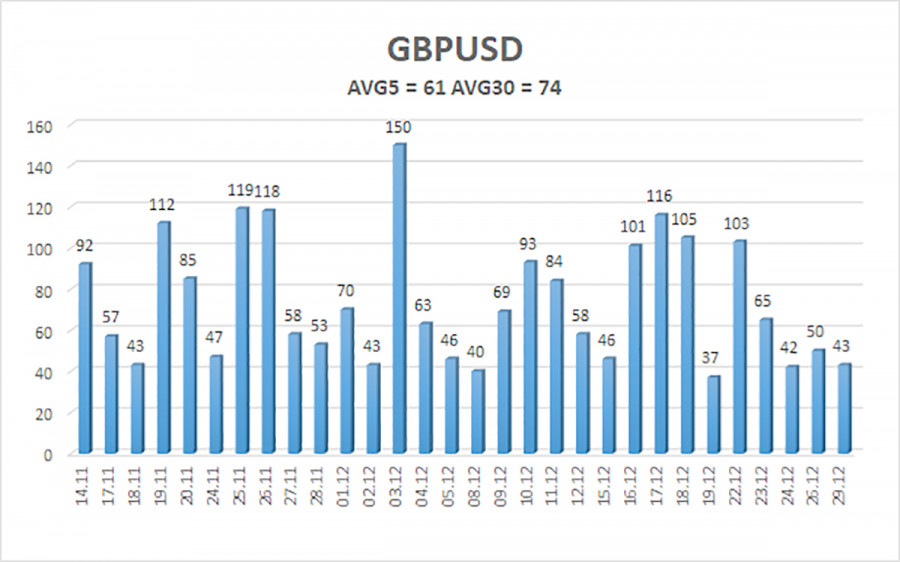

The average volatility of the GBP/USD pair over the last five trading days is 61 pips. For the pound/dollar pair, this value is considered "average-low." On Tuesday, December 30, we expect the pair to trade within the range between 1.3428 and 1.3550. The upper channel of the linear regression has turned upward, indicating a trend recovery. The CCI indicator has entered the oversold area 6 times in recent months and has formed numerous bullish divergences, consistently signaling a resumption of the upward trend.

Nearest Support Levels:

- S1 – 1.3489

- S2 – 1.3428

- S3 – 1.3367

Nearest Resistance Levels:

Trading Recommendations:

The GBP/USD currency pair is attempting to resume the upward trend of 2025, and its long-term prospects remain unchanged. Donald Trump's policies will continue to exert pressure on the dollar; therefore, we do not expect the US currency to grow. Thus, long positions targeting 1.3550 remain relevant for the near term as long as the price stays above the moving average. If the price is below the moving average, minor short positions may be considered, targeting 1.3428 and 1.3367 on technical grounds. From time to time, the US currency shows corrections (in the global context), but for a trend strengthening, it needs signs of an end to the trade war or other global positive factors.

Explanations for Illustrations:

- Linear regression channels help to identify the current trend. If both are pointing in one direction, the trend is currently strong.

- The moving average line (20,0 smoothed) indicates the short-term trend and the direction in which trading should currently be conducted.

- Murray levels – target levels for movements and corrections.

- Volatility levels (red lines) – the probable price channel within which the pair will move over the next 24 hours, based on current volatility figures.

- The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is nearing in the opposite direction.