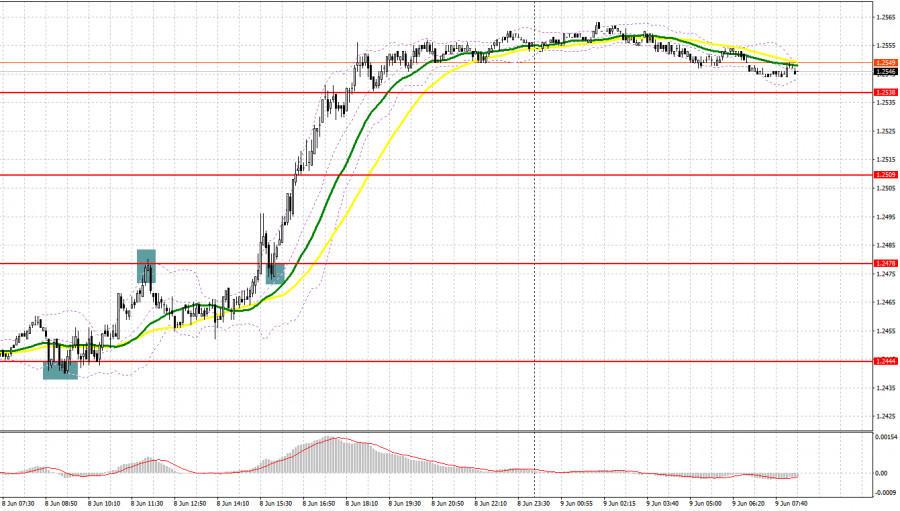

Yesterday, there were several entry points. Now let's look at the 5-minute chart and try to figure out what actually happened. In the morning article, I highlighted the level of 1.2441 and recommended taking decisions with this level in focus. A decline and a false breakout of this level gave an excellent buy signal, which resulted in an increase of more than 30 pips. Bears actively defending the resistance at 1.2471 produced a sell signal, resulting in the pair's fall by more than 20 pips. In the second half of the day, a breakout and a downward retest to 1.2478 gave another buy signal, which resulted in an increase of another 60 pips.

For long positions on GBP/USD:

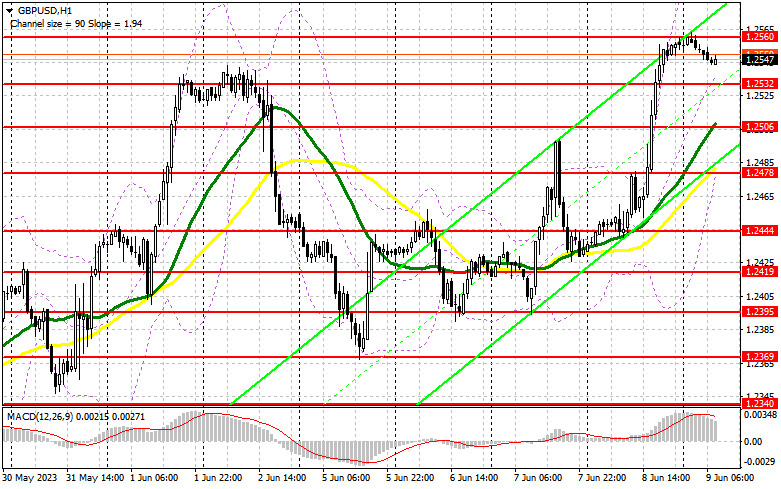

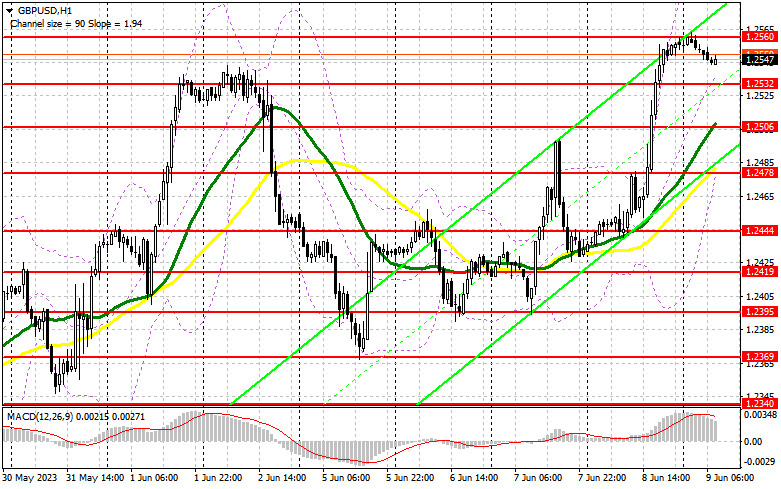

In the UK, there are still no significant events lined up, which in theory should help the pound to extend its rally against the US dollar. But considering that many indicators show that GBP/USD is overbought, I don't want to enter long positions at monthly highs towards the end of the week. I will act on the decline from a short position. A false breakout around a new support level at 1.2532 may give an entry point into long positions in the continuation of the bullish market. A new resistance level at 1.2583 will be the next target. A breakout and consolidation above this level could create an additional buy signal with a jump to 1.2611. A more distant target will be the 1.2636 level where I recommend locking in profits.

If it declines to 1.2532 and bulls show no activity, the pressure on the pound will increase and bears can seize the moment and block all of yesterday's gains. In this case, only the protection of 1.2506, where the moving averages pass, and a false breakout of this level will give new entry points into long positions. You could buy GBP/USD at a bounce from 1.2506, keeping in mind an upward intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers were not active yesterday and now it will be very difficult to catch onto the market, especially towards the end of the week. I plan to sell the pound after the test of the resistance level of 1.2560, and I'll count on the big players. The formation of a false breakout there, along with divergence on the MACD indicator, will signal the opening of short positions, which could lead to a downward movement of the pair towards 1.2532. A breakout and an upward retest of this level may deal a serious blow to the buyers' positions, which can escalate pressure on GBP/USD, generating a sell signal. The pair could decline to 1.2506. A more distant target will be the 1.2478 level where I recommend locking in profits. If GBP/USD rises and bears fail to defend 1.2560, which I assume will be the case, the bullish trend of GBP/ USD may persist. In this case, I would advise you to postpone short positions until a breakout of the 1.2583 high. If there is no downward movement there, you could sell GBP/USD at a bounce from 1.2611, bearing in mind a downward intraday correction of 30-35 pips.

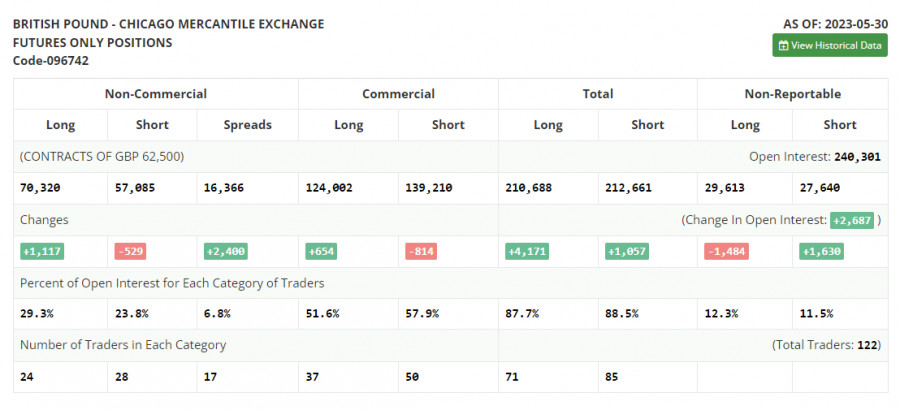

COT report:

The COT report (Commitment of Traders) for May 30 showed a drop in short positions and an increase in long positions. The pound experienced a significant decline, but decent statistics released last week helped to halt the decline and partially recoup losses suffered in May. However, expectations that the Federal Reserve will continue to raise interest rates are capping the pair's upside potential. Despite the central bank's pause in June, an overheated labor market will not allow the committee to halt the cycle of tightening monetary policy for long. Further uncertainty about the BoE's monetary policy will exert pressure on the British pound. According to the last COT report, short non-commercial positions decreased by 529 to 57,085, while long non-commercial positions increased by 1,117 to 70,320. This led to an increase in the non-commercial net position to 13,235 from 11,059 a week earlier. The weekly price decreased to 1.2398 from 1.2425.

Indicator signals:

Moving Averages

Trading is performed above the 30- and 50-day moving averages, indicating an uptrend is developing.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair falls, the lower band of the indicator at 1.2478 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.